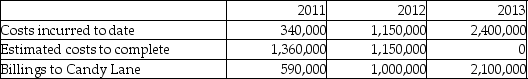

On July 1, 2011, Cusak Construction Company Inc. contracted to build an office building for Candy Lane Corp. for a total contract price of $2,150,000. On July 1, Cusak estimated that it would take between two and three years to complete the building. In October 2013, the building was deemed substantially completed. Following are accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to Candy Lane in 2011, 2012, and 2013.

Required:

Required:

Using the percentage of completion method, calculate the revenue and profit or loss to be recognized as a result of this contract for the years ended December 31, 2011, 2012, and 2013. The company used the cost-to-cost method to estimate the percentage complete.

Correct Answer:

Verified

Q63: Which statement best explains the completed contract

Q81: Which statement is correct about the "winner's

Q83: Briefly explain the following terms:

a)Non-monetary exchange transaction

b)Consignment

Q84: How is income and expense recognized for

Q87: What disclosures are required under IFRS for

Q88: What are some exceptions to the use

Q89: Smile Operators entered into a contract to

Q96: How is the prudence principle applied to

Q99: Which statement is correct about the impact

Q100: Why is there risk of earnings overstatement

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents