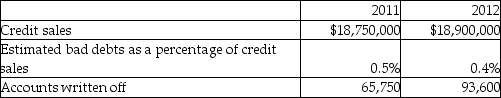

Brasser Co. started using the percentage of sales method to account for bad debts in 2012. In 2011, the company's first fiscal year, the company had used the direct write-off method because the amount of bad debts was judged to be immaterial. The following information relates to the company's sales and receivables.

Required:

Required:

a. Calculate the correct balance in the allowance for doubtful accounts (ADA)at the end of 2012. Remember to include the effect of the change in accounting policy on 2011 accounts.

b. Record the write-off entry for 2012 and the year-end adjusting entries for 2012 to adjust the ADA. (Ignore income tax effects)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q105: Speed Motorcycles sold $550,000 of receivables to

Q106: Explain how a company can use its

Q107: Explain how a company's revenue recognition policy

Q110: The accounting records of 10Com Ltd. show

Q111: The December 31, 2012 financial statements of

Q115: Soorya Inc. had the following balances for

Q116: Which of the following is a difference

Q117: Eastwick Company is preparing its financial statement

Q119: Khanna Inc. had the following transactions, information

Q119: Collier Port Authority has had a long-standing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents