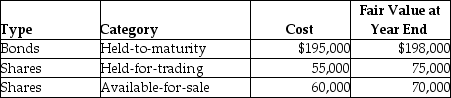

Investment Company (IC) began operations on January 1, 2012. It acquired the following investments:  IC earned interest of $12,000 during 2012. Dividends of $16,000 were declared on the shares it owned during 2012. Of that amount, $9,000 was received in December 2012 and $7,000 was received in January 2013 (note that the ex-dividend date for these shares was prior to the end of the year) . How much would be recorded as accumulated other comprehensive income on IC's balance sheet at December 31, 2012?

IC earned interest of $12,000 during 2012. Dividends of $16,000 were declared on the shares it owned during 2012. Of that amount, $9,000 was received in December 2012 and $7,000 was received in January 2013 (note that the ex-dividend date for these shares was prior to the end of the year) . How much would be recorded as accumulated other comprehensive income on IC's balance sheet at December 31, 2012?

A) $10,000 gain

B) $10,000 loss

C) $30,000 gain

D) $30,000 loss

Correct Answer:

Verified

Q76: Satellite Corporation has the following investments at

Q77: Which investment could be classified as held

Q78: Fisher Corporation has the following investments at

Q79: What factor is not important in classifying

Q80: What factor(s)differentiate a held-to-maturity investment from a

Q82: Nevill Corp invests in short term investments.

Q83: Amacon Corporation has the following investments at

Q84: McGyer Limited invests its excess cash in

Q85: Explain the nature of and the impact

Q86: Explain the nature of and the appropriate

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents