Willow Corp. is a real estate developer with its headquarters in Burlington, Ontario.

As a result of recent increases in land prices, Willow has accumulated a substantial amount of excess cash. It is looking to invest in a building supply company, but has not yet found a suitable company. To earn a reasonable return and to minimize risk, Willow invests its excess cash in common shares of large, stable corporations.

1. On Jan 1, 2011, Willow paid $1,080,000 to purchase 120,000 common shares of North Line.

2. On December 27, 2011, North Line declared and paid a dividend of $0.25 per common share.

3. On December 31, 2011, the market value of the common shares was $1,200,000.

4. On June 30, 2012, Willow sold the common shares for $1,620,000.

Required:

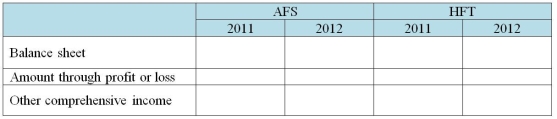

Using the following table, indicate the amounts to be reported in the balance sheet, through profit or loss, and through other comprehensive income for 2011 and 2012 under two scenarios:

a. Willow designates the common shares as an available-for-sale (AFS)investment.

b. Willow designates the common shares as a held-for-trading (HFT)investment.

Correct Answer:

Verified

Q105: On January 1, 2011, Anny Marine Supplies

Q106: Fish Corp. purchases a $100,000 face value

Q107: On January 25, 2012, Harper Ltd. purchased

Q108: Which statement is correct about non-strategic investments?

A)IFRS

Q109: Which statement is correct about non-strategic financial

Q111: Which statement is correct about non-strategic financial

Q112: On January 1, 2013, a company pays

Q113: On January 1, 2013, a company pays

Q114: Which statement is not correct about non-strategic

Q115: During 2011, Farrah Ltd. purchased 4,000 shares

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents