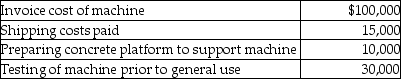

On January 1, 2013, BigBen purchased a machine, incurring the expenditures listed below. The machine had an estimated useful life of 10 years, and BigBen uses straight-line depreciation for its equipment.  What amount should be capitalized as the cost of the machinery for 2013?

What amount should be capitalized as the cost of the machinery for 2013?

A) $100,000

B) $110,000

C) $115,000

D) $155,000

Correct Answer:

Verified

Q1: Which of the following is a concern

Q7: What costs should not be capitalized to

Q8: What is the IFRS treatment for replacements

Q10: Under ASPE, what is the acceptable treatment

Q12: What costs should not be capitalized to

Q12: In December 2012, Ami, the owner of

Q15: Under IFRS, what is the acceptable treatment

Q17: Which of the following is a not

Q18: What costs should not be capitalized to

Q19: What costs should be capitalized to "land"?

A)Construction

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents