In December 2013, Bea, the owner of Walnut Corp, paid for a parcel of land along with a warehouse on behalf of Walnut, the registered owner of the property, for a total cost of $1,500,000. Bea also paid a real estate commission of $40,000 and legal fees of $10,000 in connection with this purchase, plus $30,000 for the demolition of the warehouse. Walnut will reimburse Bea for these costs in January 2014 and will begin construction of an office building on this land. Prior to the purchase, the land and warehouse were appraised at $900,000 and $600,000, respectively.

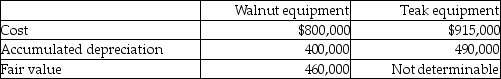

On December 31, 2013, Walnut Corp and Teak Corp. exchanged equipment. The exchange met the test for commercial substance for accounting purposes. Details of the carrying values and fair values of the equipment on the date of the exchange were as follows:

On October 1, 2013, Walnut purchased some land by signing a three-year non-interest-bearing note payable for $500,000. Walnut pays interest at the rate of 12% on other loans and was pleased to get a non-interest-bearing note payable on this deal.

On October 1, 2013, Walnut purchased some land by signing a three-year non-interest-bearing note payable for $500,000. Walnut pays interest at the rate of 12% on other loans and was pleased to get a non-interest-bearing note payable on this deal.

Required:

Prepare the required journal entries for these transactions, as well as any related year-end adjustments. Ignore income taxes. Round all values to the nearest dollar, if necessary.

Correct Answer:

Verified

Q110: Will the method of depreciation affect the

Q111: Ronald exchanged similar assets with Silver Company

Q118: Francisco purchased a machine on Jan 1,

Q119: A machine was purchased during 2013 for

Q121: Growth Industries incurred the following costs in

Q123: The following transactions occurred in fiscal 2012:

•Synthesize

Q124: On March 31, 2013, a machine costing

Q125: Grape Company (GC)had been renting an office

Q126: Aye Corp acquired land and a building

Q127: On March 31, 2013, a machine costing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents