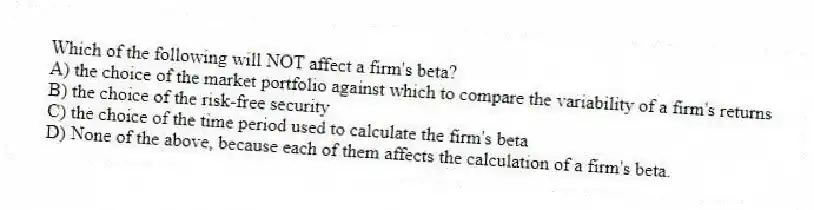

Which of the following will NOT affect a firm's beta?

A) the choice of the market portfolio against which to compare the variability of a firm's returns

B) the choice of the risk-free security

C) the choice of the time period used to calculate the firm's beta

D) None of the above, because each of them affects the calculation of a firm's beta.

Correct Answer:

Verified

Q9: Other things equal, a firm that must

Q10: The after-tax cost of debt is found

Q11: The capital asset pricing model (CAPM) is

Q12: Which of the following is NOT a

Q13: Relatively high costs of capital are more

Q15: A firm whose equity has a beta

Q16: The difference between the expected (or required)

Q17: The weighted average cost of capital (WACC)

Q18: Systematic risk:

A) is the standard deviation of

Q19: Beta may be defined as:

A) the measure

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents