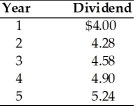

A firm has common stock with a market price of $100 per share and an expected dividend of $5.61 per share at the end of the coming year. A new issue of stock is expected to be sold for $98, with $2 per share representing the underpricing necessary in the competitive capital market. Flotation costs are expected to total $1 per share. The dividends paid on the outstanding stock over the past five years are as follows:  The cost of this new issue of common stock is ________.

The cost of this new issue of common stock is ________.

A) 5.8 percent

B) 7.7 percent

C) 10.8 percent

D) 12.8 percent

Correct Answer:

Verified

Q83: One of the circumstances in which the

Q84: The cost of common stock equity may

Q85: In comparing the constant-growth model and the

Q86: The cost of common stock equity is

Q87: A corporation has concluded that its financial

Q89: Given that the cost of common stock

Q90: In calculating the cost of common stock

Q91: In calculating the cost of common stock

Q92: The cost of common stock equity may

Q93: What would be the cost of new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents