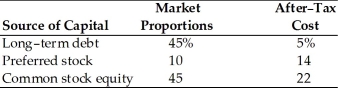

A firm has determined its cost of each source of capital and optimal capital structure, which is composed of the following sources and current market value proportions:  Other things remaining constant, if the firm were to shift toward a capital structure with ________ the weighted average cost of capital will be higher.

Other things remaining constant, if the firm were to shift toward a capital structure with ________ the weighted average cost of capital will be higher.

A) 45% long-term debt, 40% common stock, and 15% preferred stock

B) 60% long-term debt, 20% common stock, and 20% preferred stock

C) 20% long-term debt, 60% common stock, and 20% preferred stock

D) 60% long-term debt, 30% common stock, and 10% preferred stock

Correct Answer:

Verified

Q104: Target weights are either book value or

Q105: Historical weights are the present value of

Q106: Since retained earnings is a more expensive

Q107: Target weights are either book value or

Q108: In computing the weighted average cost of

Q110: Since retained earnings are viewed as a

Q111: The weights used in weighted average cost

Q112: Weights that use accounting values to measure

Q113: A firm may face increase in the

Q114: In computing the weighted average cost of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents