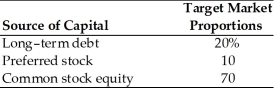

Table 9.1

A firm has determined its optimal capital structure which is composed of the following sources and target market value proportions.  Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

Debt: The firm can sell a 12-year, $1,000 par value, 7 percent bond for $960. A flotation cost of

2 percent of the face value would be required in addition to the discount of $40.

Preferred Stock: The firm has determined it can issue preferred stock at $75 per share par value. The stock will pay a $10 annual dividend. The cost of issuing and selling the stock is $3 per share.

Common Stock: A firm's common stock is currently selling for $18 per share. The dividend expected to be paid at the end of the coming year is $1.74. Its dividend payments have been growing at a constant rate for the last four years. Four years ago, the dividend was $1.50. It is expected that to sell, a new common stock issue must be underpriced $1 per share in floatation costs. Additionally, the firm's marginal tax rate is 40 percent.

-If the target market proportion is reduced to 15 percent, what will be the revised weighted average cost of capital? (See Table 9.1)

A) 13.6 percent

B) 11.0 percent

C) 12.34 percent

D) 10.4 percent

Correct Answer:

Verified

Q124: Table 9.2

A firm has determined its optimal

Q125: A firm has determined its optimal capital

Q126: Table 9.1

A firm has determined its optimal

Q127: Table 9.1

A firm has determined its optimal

Q128: Table 9.1

A firm has determined its optimal

Q130: Table 9.2

A firm has determined its optimal

Q131: Table 9.2

A firm has determined its optimal

Q132: Table 9.2

A firm has determined its optimal

Q133: Promo Pak has compiled the following financial

Q134: Table 9.1

A firm has determined its optimal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents