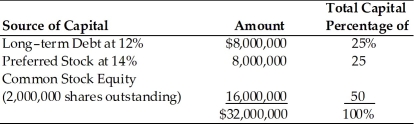

Zheng Sen's Chinese Take-Out had earnings before interest and taxes of $4,000,000 last year. The firm has a marginal tax rate of 40 percent and currently has the following capital structure:  (a) Calculate the firm's after-tax return on equity (ROE) and earnings per share (EPS).

(a) Calculate the firm's after-tax return on equity (ROE) and earnings per share (EPS).

(b) If the firm retires $4,000,000 of preferred stock using the proceeds from an equal increase in long-term debt, what would have been the after-tax return on equity (ROE) and earnings per share (EPS)?

(c) If the firm retires $4,000,000 of preferred stock using the proceeds from the sale of 500,000 shares of common stock, what would have been the after-tax return on equity (ROE) and earnings per share (EPS)?

Correct Answer:

Verified

** R...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q111: The constant growth model is an approach

Q112: According to the efficient market hypothesis, prices

Q113: Investors purchase a stock when they believe

Q114: In an efficient market, stock prices adjust

Q115: Behavioral finance is a growing body of

Q117: If the expected return were above the

Q118: The constant growth model is an approach

Q119: If expected return is less than required

Q120: In an inefficient market, securities are typically

Q121: Which of the following is true of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents