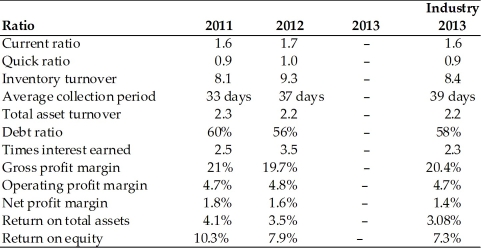

Given the following balance sheet, income statement, historical ratios and industry averages, calculate the Pulp, Paper, and Paperboard, Inc. financial ratios for the most recent year. Analyze its overall financial situation for the most recent year. Analyze its overall financial situation from both a cross-sectional and time-series viewpoint. Break your analysis into an evaluation of the firm's liquidity, activity, debt, and profitability.

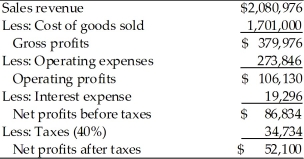

Income Statement

Pulp, Paper, and Paperboard, Inc.

For the Year Ended December 31, 2013  Balance Sheet

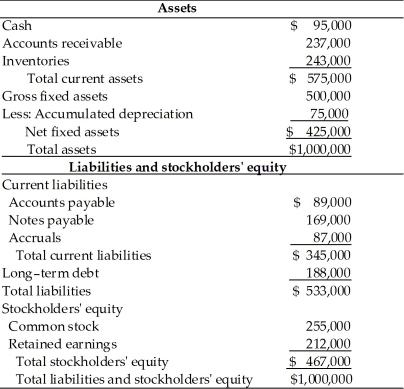

Balance Sheet

Pulp, Paper, and Paperboard, Inc.

December 31, 2013  Historical and Industry Average Ratios

Historical and Industry Average Ratios

Pulp, Paper and Paperboard, Inc.

Correct Answer:

Verified

P...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q197: Table 3.2

Dana Dairy Products Key Ratios

Q198: A firm with a low net profit

Q199: Table 3.2

Dana Dairy Products Key Ratios

Q200: Table 3.2

Dana Dairy Products Key Ratios

Q201: Table 3.2

Dana Dairy Products Key Ratios

Q203: As the financial leverage multiplier increases, this

Q204: Table 3.2

Dana Dairy Products Key Ratios

Q205: Complete the balance sheet for General Aviation,

Q206: In an effort to analyze Clockwork Company

Q207: Table 3.2

Dana Dairy Products Key Ratios

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents