A multinational company has two subsidiaries, one in U.K (local currency, Pound Sterling) and the other in Germany (local currency, Euro). Proforma statements of operations indicate the following short-term financial needs for each subsidiary (in equivalent U.S. dollars): U.K: $25 million excess cash to be invested (lent); Germany: $10 million funds to be raised (borrowed)

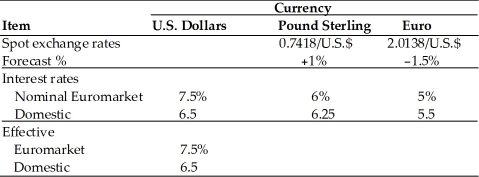

The following financial data is also available:  (a) Determine the effective rates of interest for Irish pound and Deutsche mark in both the Euromarket and the domestic market.

(a) Determine the effective rates of interest for Irish pound and Deutsche mark in both the Euromarket and the domestic market.

(b) Where should the funds be invested?

(c) Where should the funds be raised?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: An international bond that is sold primarily

Q84: A Eurobond is _.

A) a bond sold

Q85: Theory and empirical evidence indicate that the

Q86: International short-term financing opportunities are available in

Q87: MNCs have lower long-term financing costs in

Q89: The usual capital markets used by U.S.-based

Q90: The existence of _ allows multinationals to

Q91: In the case of short-term financing, the

Q92: In capital budgeting for a multinational company,

Q93: In the international context, the _ interest

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents