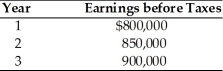

Maxi, Inc. is evaluating the acquisition of Mini, Inc., which had a loss carryforward of $2.75 million which resulted from earlier operations. Maxi can purchase Mini for $3.5 million and liquidate the assets for $1.25 million. Maxi expects earnings before taxes in the three years following the acquisition to be as follows:  (These earnings are assumed to fall within the limit legally allowed for application of a tax loss carryforward resulting from the proposed acquisition.) Maxi has a 40 percent tax rate and a cost of capital of 10 percent. The total present value of tax advantage of the acquisition in the following three years is ________.

(These earnings are assumed to fall within the limit legally allowed for application of a tax loss carryforward resulting from the proposed acquisition.) Maxi has a 40 percent tax rate and a cost of capital of 10 percent. The total present value of tax advantage of the acquisition in the following three years is ________.

A) $440,374

B) $842,374

C) $1.1 million

D) $2.75 million

Correct Answer:

Verified

Q96: A divestiture that results in an operating

Q97: A leveraged buyout needs to be carried

Q98: The sale of a unit of a

Q99: The value of a firm measured as

Q100: Which of the following is true of

Q102: A stock swap transaction is an acquisition

Q103: Acquisitions are especially attractive when an acquiring

Q104: If the net present value of the

Q105: A method of acquisition in which the

Q106: Acquisitions are especially attractive when a target

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents