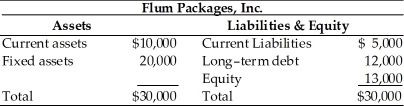

Table 15.2  The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

-If the firm was to shift $7,000 of fixed assets to current assets, the firm's net working capital would ________, and the risk of not being able to meet current obligations would ________, respectively. (See Table 15.2)

A) increase; increase

B) decrease; decrease

C) increase; decrease

D) decrease; increase

Correct Answer:

Verified

Q84: An increase in the average payment period

Q85: Table 15.2 Q86: An decrease in the current liabilities to Q87: The difference between the number of days Q88: An increase in the current asset to Q90: A decrease in the current asset to Q91: An increase in the current liabilities to Q92: Table 15.1 Q93: Table 15.2 Q94: Which of the following is true of![]()

Irish Air Services has determined several![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents