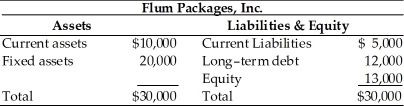

Table 15.2  The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

-If the firm was to shift $2,000 of current liabilities to long-term funds, the firm's net working capital would ________, the annual cost of financing would ________, and the risk of insolvency would ________, respectively. (See Table 15.2)

A) decrease; decrease; increase

B) increase; increase; decrease

C) decrease; increase; decrease

D) increase; decrease; decrease

Correct Answer:

Verified

Q88: An increase in the current asset to

Q89: Table 15.2 Q90: A decrease in the current asset to Q91: An increase in the current liabilities to Q92: Table 15.1 Q94: Which of the following is true of Q95: Table 15.1 Unlock this Answer For Free Now! View this answer and more for free by performing one of the following actions Scan the QR code to install the App and get 2 free unlocks Unlock quizzes for free by uploading documents![]()

Irish Air Services has determined several

Irish Air Services has determined several