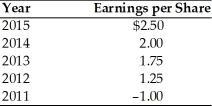

A firm has had the following earnings history over the last five years:  If the firm's dividend policy was based on a constant payout ratio of 50 percent for all of the years with earnings over $1.50 per share and a zero payout otherwise, the annual dividends for 2012 and 2015 were ________.

If the firm's dividend policy was based on a constant payout ratio of 50 percent for all of the years with earnings over $1.50 per share and a zero payout otherwise, the annual dividends for 2012 and 2015 were ________.

A) $0.50 and $1.25, respectively

B) $0 and $2.00, respectively

C) $0 and $1.25, respectively

D) $0 and $0.88, respectively

Correct Answer:

Verified

Q89: A constant-payout-ratio dividend policy is based on

Q90: With regard to dividend payments, which of

Q91: The problem with the regular dividend policy

Q92: Regularly paying a fixed or increasing dividend

Q93: At a firm's quarterly dividend meeting held

Q95: Which of the following is considered in

Q96: According to _, investors' demands for dividends

Q97: According to the catering theory, firms cater

Q98: Which type of dividend payment policy has

Q99: A firm has had the following earnings

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents