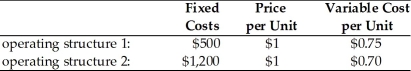

China America Manufacturing is evaluating two different operating structures which are described below. The firm has annual interest expense of $250, common shares outstanding of 1,000, and a tax rate of 40 percent.  (a) For each operating structure, calculate

(a) For each operating structure, calculate

(a1) EBIT and EPS at 10,000, 20,000, and 30,000 units.

(a2) the degree of operating leverage (DOL) and degree of total leverage (DTL) using 20,000 units as a base sales level.

(a3) the operating breakeven point in units.

(b) Which operating structure has greater operating leverage and business risk?

(c) If China America projects sales of 20,000 units, which operating structure is recommended?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q112: A firm has EBIT of $375,000, interest

Q113: A firm's capital structure is the mix

Q114: At a base sales level of $400,000,

Q115: _ leverage is concerned with the relationship

Q116: A firm's capital structure can significantly affect

Q118: Because the degree of total leverage is

Q119: Due to its secondary position relative to

Q120: Yongman Electronics has decided to invest $10,000,000

Q121: Despite the extensive research conducted in recent

Q122: Business risk is the risk to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents