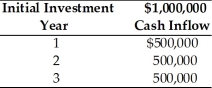

Table 12.2

A firm is considering investment in a capital project which is described below. The firm's cost of capital is 18 percent and the risk-free rate is 6 percent. The project has a risk index of 1.5. The firm uses the following equation to determine the risk adjusted discount rate, RADR, for each project: RADR = Rf + Risk Index (Cost of capital - Rf)

-The discount rate that should be used in the net present value calculation to compensate for risk is ________. (See Table 12.2)

A) 6 percent

B) 15 percent

C) 18 percent

D) 24 percent

Correct Answer:

Verified

Q65: The theoretical basis from which the concept

Q66: Table 12.2

A firm is considering investment in

Q67: When unequal-lived projects are independent, the length

Q68: A preferred approach for risk adjustment of

Q69: Table 12.4

Johnson Farm Implement is faced with

Q71: Table 12.3

Tangshan Mining Company is considering investment

Q72: Table 12.5

Nico Manufacturing is considering investment in

Q73: Table 12.3

Tangshan Mining Company is considering investment

Q74: Table 12.3

Tangshan Mining Company is considering investment

Q75: The difference by which the required discount

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents