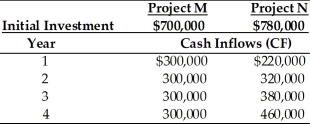

Table 12.3

Tangshan Mining Company is considering investment in one of two mutually exclusive projects M and N which are described below. Tangshan Mining's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Tangshan estimates that the beta for project M is 1.20 and the beta for project N is 1.40.

-Using the risk-adjusted discount rate method of project evaluation, the better investment for Tangshan Mining is ________. (See Table 12.3)

A) Project M because it has a higher NPV

B) Project N because it has a higher NPV

C) Project N because it has a higher IRR

D) Project M because it has a higher IRR

Correct Answer:

Verified

Q58: In applying risk-adjusted discount rates to project

Q59: Because a business firm can be viewed

Q60: Because of the basic mathematics of compounding

Q61: Table 12.5

Nico Manufacturing is considering investment in

Q62: Table 12.2

A firm is considering investment in

Q64: The shares traded publicly in an efficient

Q65: The theoretical basis from which the concept

Q66: Table 12.2

A firm is considering investment in

Q67: When unequal-lived projects are independent, the length

Q68: A preferred approach for risk adjustment of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents