Table 12.5

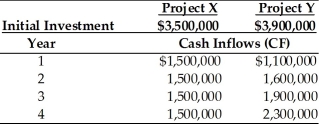

Nico Manufacturing is considering investment in one of two mutually exclusive projects X and Y which are described below. Nico Manufacturing's overall cost of capital is 15 percent, the market return is 15 percent and the risk-free rate is 5 percent. Nico estimates that the beta for project X is 1.20 and the beta for project Y is 1.40.

-Calculate the risk-adjusted discount rates for Project X and Project Y. (See Table 12.5)

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: Table 12.3

Tangshan Mining Company is considering investment

Q75: The difference by which the required discount

Q76: Table 12.4

Johnson Farm Implement is faced with

Q77: Table 12.5

Nico Manufacturing is considering investment in

Q78: In case of unequal-lived, mutually exclusive projects,

Q80: Firms do not usually get rewarded by

Q81: The _ approach is used to convert

Q82: Table 12.6

Yong Importers, an Asian import company,

Q83: The objective of capital rationing is to

Q84: Table 12.6

Yong Importers, an Asian import company,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents