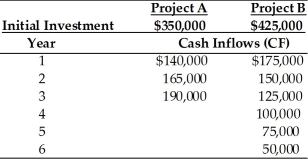

Table 12.6

Yong Importers, an Asian import company, is evaluating two mutually exclusive projects, A and B. The relevant cash flows for each project are given in the table below. The cost of capital for use in evaluating each of these equally risky projects is 10 percent.

-Which project should be chosen on the basis of the normal NPV approach? (See Table 12.6)

A) Project A because its NPV is higher

B) Project B because its NPV is higher

C) Project A because its IRR is higher

D) Project B because its IRR is higher

Correct Answer:

Verified

Q81: The _ approach is used to convert

Q82: Table 12.6

Yong Importers, an Asian import company,

Q83: The objective of capital rationing is to

Q84: Table 12.6

Yong Importers, an Asian import company,

Q85: A(n) _ allows management to avoid or

Q87: Table 12.6

Yong Importers, an Asian import company,

Q88: When unequal-lived projects are independent, the impact

Q89: Real options are opportunities that are embedded

Q90: A firm is evaluating two mutually exclusive

Q91: The risk-adjusted discount rate approach to evaluating

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents