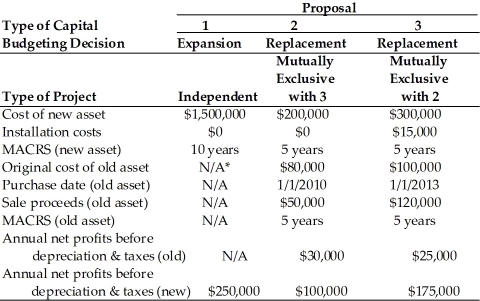

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2014. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

________________________________________________________  *Not applicable

*Not applicable

-For Proposal 2, the tax effect on the sale of the existing asset at the end of the fifth year results in ________. (See Table 11.2)

A) $12,000 tax liability

B) $14,560 tax liability

C) $25,280 tax liability

D) $16,600 tax liability

Correct Answer:

Verified

Q85: Table 11.2

Computer Disk Duplicators, Inc. has been

Q86: Table 11.3

Cuda Marine Engines, Inc. must develop

Q87: Table 11.2

Computer Disk Duplicators, Inc. has been

Q88: Table 11.4

Degnan Dance Company, Inc., a manufacturer

Q89: Table 11.2

Computer Disk Duplicators, Inc. has been

Q91: Table 11.3

Cuda Marine Engines, Inc. must develop

Q92: Table 11.4

Degnan Dance Company, Inc., a manufacturer

Q93: Table 11.2

Computer Disk Duplicators, Inc. has been

Q94: Table 11.2

Computer Disk Duplicators, Inc. has been

Q95: Table 11.3

Cuda Marine Engines, Inc. must develop

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents