-A corporation is evaluating the relevant cash flows for a capital budgeting decision and must estimate the terminal cash flow. The proposed machine will be disposed of at the end of its usable life of five years at an estimated sale price of $2,000. The machine has an original purchase price of $80,000, installation cost of $20,000, and will be depreciated under the five-year MACRS. Net working capital is expected to decline by $5,000. The firm has a 40 percent tax rate on ordinary income and long-term capital gain. The terminal cash flow is ________.

A) $5,800

B) $7,800

C) $8,200

D) $6,200

Correct Answer:

Verified

Q106: Table 11.4

Degnan Dance Company, Inc., a manufacturer

Q107: Table 11.4

Degnan Dance Company, Inc., a manufacturer

Q108: Table 11.5

Nuff Folding Box Company, Inc. is

Q109: Table 11.5

Nuff Folding Box Company, Inc. is

Q110: Table 11.4

Degnan Dance Company, Inc., a manufacturer

Q112: Table 11.5

Nuff Folding Box Company, Inc. is

Q113: Table 11.4

Degnan Dance Company, Inc., a manufacturer

Q114: Table 11.4

Degnan Dance Company, Inc., a manufacturer

Q115: Table 11.4

Degnan Dance Company, Inc., a manufacturer

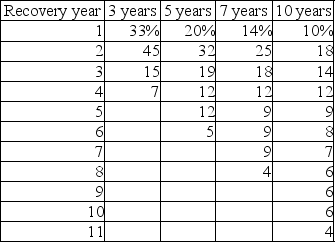

Q116: ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents