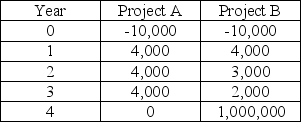

Evaluate the following projects using the payback method assuming a rule of 3 years for payback.

A) Project A can be accepted because the payback period is 2.5 years but Project B cannot be accepted because its payback period is longer than 3 years.

B) Project B should be accepted because even though the payback period is 2.5 years for Project A and 3.001 for project B, there is a $1,000,000 payoff in the 4th year in Project B.

C) Project B should be accepted because you get more money paid back in the long run.

D) Both projects can be accepted because the payback is less than 3 years.

Correct Answer:

Verified

Q94: Some firms use the payback period as

Q95: A sophisticated capital budgeting technique that can

Q96: A sophisticated capital budgeting technique that can

Q97: If the NPV is greater than $0,

Q98: For a project that has an initial

Q100: If the NPV is less than the

Q101: A sophisticated capital budgeting technique that can

Q102: The internal rate of return (IRR) is

Q103: The minimum return that must be earned

Q104: If a project's IRR is greater than

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents