The Bristol-Fuller partnership was formed on January 1,2016,when Bristol and Fuller invested $40,000 and $30,000 cash in the partnership,respectively.During 2016,the partnership earned $75,000 in cash revenues and paid $52,000 in cash expenses.Bristol withdrew $5,000 cash from the business during the year,and Fuller withdrew $4,000.The partnership agreement specified that net income should be allocated equally to the partners' capital accounts.

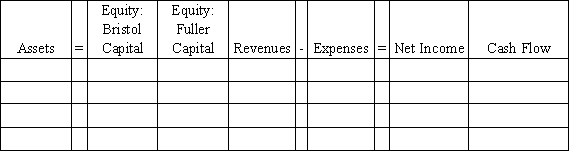

Required: Indicate how each of the transactions and events for the Bristol partnership affects the financial statements model,below.Indicate dollar amounts of increases and decreases.For cash flows,indicate whether each is an operating activity (OA),investing activity (IA),or financing activity (FA).Indicate NA if an element is not affected by a transaction.

Correct Answer:

Verified

Q77: Preferred stockholders' claims to a corporation's assets

Q81: A high price-earnings ratio generally means that

Q82: Powell Corporation had $10 par stock with

Q85: Weller Corporation issued 10,000 shares of no-par

Q86: A corporation must record a liability for

Q91: A purchase of treasury stock is an

Q126: The Mason-Dixon partnership was formed on January

Q127: Treasury Stock is an equity account with

Q131: An appropriation of retained earnings places a

Q134: The Rubble-Flintstone Company was started on January

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents