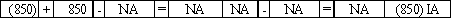

On January 1,2016,Ruiz Company spent $850 on a plant asset to improve its quality.The asset had been purchased on January 1,2014 for $8,400 and had an estimated salvage value of $1,200 and a useful life of five years.Owens uses the straight-line depreciation method.Which of the following correctly shows the effects of the 2016 expenditure on the financial statements?

Correct Answer:

Verified

Q22: Which of the following statements is true

Q65: Good Company paid cash to purchase mineral

Q67: On January 1,2016 Ballard Company spent $12,000

Q68: Use the following to answer questions

Farmer Company

Q69: Gillock,Inc.uses MACRS for its income tax returns

Q71: Madison Company owned an asset that had

Q72: Use the following to answer questions

Farmer Company

Q73: Anton Company paid cash to prolong the

Q74: On January 1,2012 Eller Company purchased an

Q75: Use the following to answer questions

Jing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents