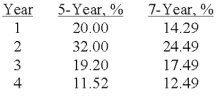

The Glover Corporation purchased $80,000 of equipment on July 1,2016.The equipment is expected to be used in the business for five years and has an estimated salvage value of $11,000.Partial MACRS tables are listed below:

Required: a)Compute the amount of depreciation that is deductible under MACRS for 2016 and 2017 assuming that the equipment is classified as 5-year property.

b)Compute the amount of depreciation that is deductible under MACRS for 2016 and 2017 assuming that the equipment is classified as 7-year property.

Correct Answer:

Verified

2016 $16...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: In choosing a depreciation method for financial

Q139: Goodwill is the value attributable to a

Q141: When Company X purchases Company Y,X should

Q142: On January 1,2016,Golden Company purchased a new

Q143: On January 1,2016,the Dartmouth Corporation paid $18,000

Q145: On January 1,2016,Jefferson Manufacturing Company purchased equipment

Q146: In January 2016,Rainey Co.purchased a machine that

Q147: On January 1,2016,Stewart Corporation purchased equipment for

Q148: Scott Company purchased a new machine on

Q149: On January 1,2016,Milwaukee Company purchased Minneapolis Company,paying

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents