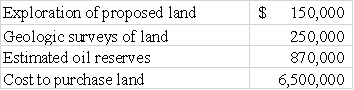

Alaska Energy Corporation paid cash to acquire land to be used for oil production.The costs incurred by Alaska Energy were the following:

Estimates were made that 3,885,000 gallons of crude oil can be extracted from the site over the life of the asset.

Required: a)Prepare the journal entry(ies)to record the purchase of the oil field.

b)Given that Alaska Energy was able to extract

230,000 gallons in the first year,

675,000 gallons in the second year,and

554,000 gallons in the third year

Calculate the depletion charge for each year.

Correct Answer:

Verified

b)Depletion rate:

$7,770,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q145: On January 1,2016,Jefferson Manufacturing Company purchased equipment

Q146: In January 2016,Rainey Co.purchased a machine that

Q147: On January 1,2016,Stewart Corporation purchased equipment for

Q148: Scott Company purchased a new machine on

Q149: On January 1,2016,Milwaukee Company purchased Minneapolis Company,paying

Q151: Mays Corporation purchased a new truck on

Q152: Sheffield Corporation purchased equipment on January 1,2016

Q153: In 2016,Hinkle Corporation Co.acquired a patent from

Q154: On May 4,2016,Steger Company purchased a tract

Q155: On January 1,2016,Phoenix Corporation purchased a delivery

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents