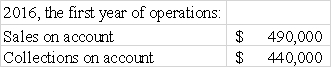

The following information is available for Phoenix Corporation,which uses the allowance method of accounting for uncollectible accounts.Phoenix expects 3% of sales on account to be uncollectible.

Required: a)Calculate the amount of uncollectible accounts expense for 2016.

b)Prepare the journal entry to record uncollectible accounts expense for 2016.

c)In 2017,after several attempts of collection,Phoenix wrote off accounts that could not be collected of $700.Prepare the journal entry to record the write-off of the $700.

d)Later in 2017,Phoenix received a check for $140 from one of the customers whose account had been written off in c),above.Prepare the required journal entries to record the collection of the $140.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: Other things being equal,the longer a company's

Q121: During 2016,Oklahoma Trucking Co.had service revenue on

Q122: Vincent Company accepted a 12-month,7% promissory note

Q123: Flagler Corporation uses the direct write-off method

Q124: The following information is available for Plains

Q125: Perez Company began 2016 with a balance

Q128: In the first year of operations,2016,Ralph's Repair

Q129: Geary,Inc.had the following sales during 2016:

Geary also

Q130: Blake Company loaned Jiminez Corporation $18,000 on

Q131: On January 1,2016,Burton Company had a balance

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents