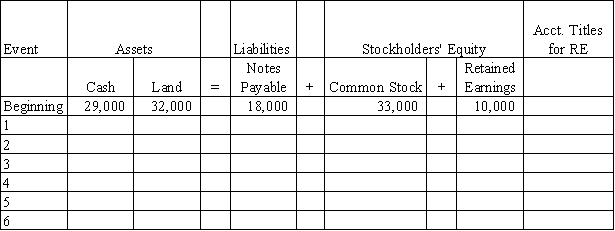

At the beginning of 2016,Grace Company's accounting records had the general ledger accounts and balances shown in the table below.During 2016,the following transactions occurred:

1.Received $95,000 cash for providing services to customers

2.Paid salaries expense,$50,000

3.Purchased land for $12,000 cash

4.Paid $4,000 on note payable

5.Paid operating expenses,$22,000

6.Paid cash dividend,$2,500

Required:

a)Record the transactions in the appropriate general ledger accounts.Record the amounts of revenue,expense,and dividends in the retained earnings column.Precede the amount with a minus sign if the transaction reduces that section of the equation.Enter 0 for items not affected.

Provide appropriate titles for these accounts in the last column of the table.

b)What is the amount of total assets as of December 31,2016?

c)What is the amount of total stockholders' equity as of December 31,2016?

Correct Answer:

Verified

b)Total assets = $33,500 + ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Borrowing money from the bank is an

Q87: All of a business's temporary accounts appear

Q89: An asset use transaction does not affect

Q128: Montgomery Company experienced the following events during

Q129: Fill in the blanks indicated by the

Q130: Jessup Company was founded in 2015.It acquired

Q131: The following transactions apply to Wilson Fitness

Q135: The transactions listed below apply to Bates

Q136: Ramirez Company experienced the following events during

Q137: Each of the following requirements is independent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents