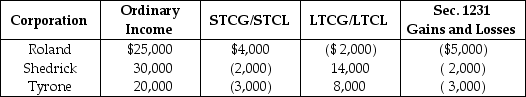

Roland,Shedrick,and Tyrone Corporations formed an affiliated group a number of years ago,which has since filed consolidated tax returns.No prior Sec 1231 losses have been reported by any group member.The group had a consolidated capital loss carryover last year.For the current year,the group reports the following results:

Which of following statements is incorrect?

A) No Sec.1231 recapture can occur this year.

B) The net capital gain is taxed at the regular corporate tax rates.

C) The Sec.1231 loss is treated as an ordinary loss.

D) The net capital gain is $20,000.

Correct Answer:

Verified

Q60: Identify which of the following statements is

Q63: A member's portion of a consolidated NOL

Q63: P-S is an affiliated group that files

Q75: What is the consequence of having losses

Q76: Boxcar Corporation and Sidecar Corporation,an affiliated group,reports

Q78: Blair and Cannon Corporations are the two

Q85: A consolidated return's tax liability is owed

Q85: Blue and Gold Corporations are members of

Q92: A consolidated NOL carryover is $52,000 at

Q93: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents