Broom Corporation transfers assets with an adjusted basis of $300,000 and an FMV of $400,000 to Docker Corporation in exchange for $400,000 of Docker Corporation stock as part of a tax-free reorganization.The Docker stock had been purchased from its shareholders one year earlier for $350,000.How much gain do Broom and Docker Corporations recognize on the asset transfer?

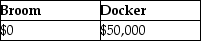

A)

B)

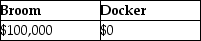

C)

D)

Correct Answer:

Verified

Q21: Parent Corporation purchases all of Target Corporation's

Q27: In a nontaxable reorganization, shareholders of the

Q33: Acquiring Corporation acquires all of the assets

Q35: Why would an acquiring corporation want an

Q36: In a nontaxable reorganization, the acquiring corporation

Q38: Bob exchanges 4000 shares of Beetle Corporation

Q54: In a Type B reorganization, the 1.

Q55: Buddy owns 100 of the outstanding shares

Q59: Marty is a party to a tax-free

Q60: Acme Corporation acquires Fisher Corporation's assets in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents