Cowboy Corporation owns 90% of the single class of stock in Doggie Corporation.The other 10% is owned by Miguel,an individual.Cowboy's basis in its Doggie Corporation stock is $100,000 and Miguel's basis is $50,000.Doggie Corporation distributes property having an adjusted basis of $150,000 and an FMV of $500,000 to Cowboy Corporation,and $60,000 of money to Miguel as a liquidating distribution.Doggie and Cowboy Corporations must recognize gain of:

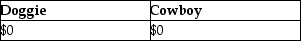

A)

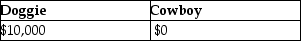

B)

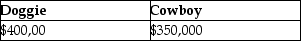

C)

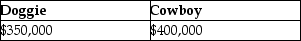

D)

Correct Answer:

Verified

Q24: Lake Corporation distributes a building used in

Q28: John and June, husband and wife, have

Q41: Under Illinois Corporation's plan of liquidation, the

Q43: A subsidiary must recognize depreciation recapture income

Q44: The liquidation of a subsidiary corporation must

Q53: Identify which of the following statements is

Q54: Carly owns 25% of Base Corporation's single

Q55: Chip and Dale are each 50% owners

Q57: What event determines when a cash or

Q58: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents