Prime Corporation liquidates its 85%-owned subsidiary Bass Corporation under the provisions of Secs.332 and 337.Bass Corporation distributes land to its minority shareholder,John,who owns a 15% interest.The property received by John has a $55,000 FMV.The land was used in the Bass Corporation's business and has a $65,000 adjusted basis and is subject to a $10,000 liability,which is assumed by John.John's basis in his stock is $25,000.What gain or loss will John and Bass Corporation recognize on the distribution of the land?

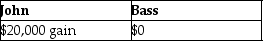

A)

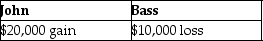

B)

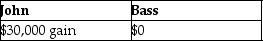

C)

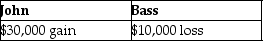

D)

Correct Answer:

Verified

Q48: Identify which of the following statements is

Q61: Lake City Corporation owns all of the

Q62: Liquidating expenses are generally deducted as ordinary

Q63: The general rule for tax attributes of

Q68: Sandy,a cash method of accounting taxpayer,has a

Q68: Lake City Corporation owns all the stock

Q72: Barbara owns 100 shares of Bond Corporation

Q73: Greg, a cash method of accounting taxpayer,

Q76: What basis do both the parent and

Q80: Identify which of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents