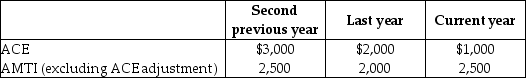

Drury Corporation,which was organized three years ago,reports the following adjusted current earnings (ACE)and preadjustment alternative minimum taxable income (AMTI)amounts.

What is the ACE adjustment to increase (or decrease)taxable income to arrive at AMTI for the second previous year?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q24: Identify which of the following statements is

Q25: Drury Corporation,which was organized three years ago,reports

Q26: Mountaineer,Inc.has the following results: Q32: Certain adjustments must be made to alternative Q33: Mountaineer,Inc.has the following results: Q34: Hydrangia Corporation reports the following results for Q35: Door Corporation's alternative minimum taxable income before Q36: How does the deduction for U.S.production activities Q38: Which of the following statements regarding the Q40: Which of the following is not an![]()

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents