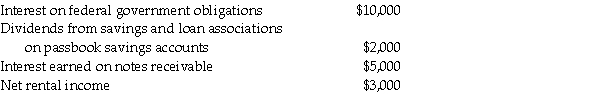

Investors Corporation has ten unrelated individual shareholders who each own 10% of the outstanding stock.For their tax year ended December 31 of this year,Investors' gross income includes:

No dividends are paid during the tax year or during the 2-1/2 month throwback period.Deductible administrative expenses total $4,000 for the year.Rental income has been reduced by $1,000 of depreciation and $2,000 of interest expense.What is Investors' undistributed personal holding company income?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: The personal holding company tax

A)may be imposed

Q22: Which of following generally does not indicate

Q25: Define personal holding company income.

Q26: Church Corporation is a closely held C

Q27: Which of the following entities is subject

Q28: A corporation can be subject to both

Q40: What is a personal holding company?

Q70: Eagle Corporation,a personal holding company,has the following

Q76: Mullins Corporation is classified as a PHC

Q77: Smartmoney,Inc.was formed by three wealthy dentists to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents