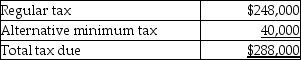

Grant Corporation is not a large corporation for estimated tax purposes and reports on a calendar-year basis.Grant expects the following results:

Grant's tax liability for last year was $240,000.Grant's minimum total estimated tax payment for this year to avoid a penalty is

A) $240,000.

B) $248,000.

C) $288,000.

D) $280,000.

Correct Answer:

Verified

Q83: Identify which of the following statements is

Q84: What are some of the advantages and

Q88: Identify which of the following statements is

Q96: Beta Corporation recently purchased 100% of XYZ

Q100: Corporate estimated tax payments are due April

Q105: Winter Corporation's taxable income is $500,000.In addition,Winter

Q108: Ben and Jerry Corporations are members of

Q108: A deferred tax asset indicates that a

Q112: Which of the following results in a

Q116: Jeffrey Corporation has asked you to prepare

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents