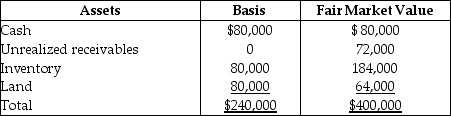

Tony sells his one-fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What are the amount and character of Tony's gain?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: On December 31,Kate receives a $28,000 liquidating

Q64: Joshua is a 40% partner in the

Q64: Identify which of the following statements is

Q68: What is the character of the gain/loss

Q69: For tax purposes, a partner who receives

Q72: Identify which of the following statements is

Q75: When a retiring partner receives payments that

Q76: Under the check-the-box rules, an LLC with

Q77: If a partner dies, his or her

Q80: Can a partner recognize both a gain

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents