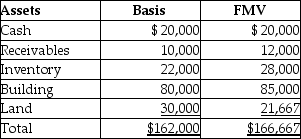

The LM Partnership terminates for tax purposes on July 15 when Latasha sells her 60% capital and profits interest to Zoe for $100,000.The partnership has no liabilities,and its assets at the time of termination are as follows:

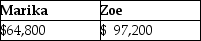

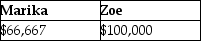

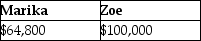

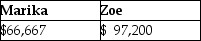

Marika,a 40% partner in the LM Partnership,has a $64,800 basis in her partnership interest (outside basis) at the time of the termination.She has held her LM Partnership interest for three years at the time of the termination.The bases of Marika and Zoe in the new LM Partnership is:

A)

B)

C)

D)

Correct Answer:

Verified

Q81: A limited liability company is a form

Q83: Identify which of the following statements is

Q87: What are some advantages and disadvantages of

Q88: Sally is a calendar-year taxpayer who owns

Q89: Patrick purchased a one-third interest in the

Q92: Quinn and Pamela are equal partners in

Q93: Which of the following is valid reason

Q93: Identify which of the following statements is

Q94: Which of the following statements is correct?

A)A

Q102: Brown Company recently has been formed as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents