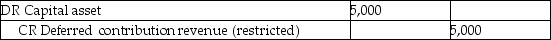

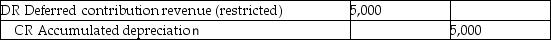

On December 1,20X1,Wilson contributed $25,000 to The Women's Shelter,stipulating that his contribution be used to buy a commercial refrigerator and freezer system.The system was purchased on January 2,20X3.The shelter will depreciate the refrigerator over 5 years using the straight-line method.The shelter has a December 31 year-end and uses the deferral method.At December 31,20X3,the shelter records a journal entry to record depreciation and should also make the following journal entry.

A)

B)

C)

D) No other entry is required.

Correct Answer:

Verified

Q6: During the year, a not-for-profit art gallery

Q12: The disbursement basis for recognizing resource outflows

Q18: For a not-for-profit organization, an expenditure is

Q19: Which of the following would result in

Q21: The transportation fleet department for a provincial

Q25: Bright School is a private school operating

Q26: For the 20X6 fiscal year,KU Care,a not-for-profit

Q27: Big Research Foundation is a large non-profit

Q29: When is an obligation recorded under an

Q30: What type of not-for-profit (NFP)organization may be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents