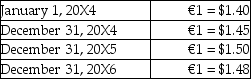

On January 1,20x4,HB Inc.issued 10,000,000 Euros (€) of bonds payable.The bonds are due on December 31,20X6.Over the life of the bonds,the exchange rates were as follows:

Assume that exchange gains and losses on long-term monetary are recognized in income immediately.What is the exchange gain (loss) recognized in income during 20X5?

A) $(1,000,000)

B) $(500,000)

C) $500,000

D) $1,000,000

Correct Answer:

Verified

Q5: Which of the following items is a

Q8: What is the exchange rate in effect

Q10: On December 1,20X5,Gillard Ltd.sold goods to International

Q11: Under the two transaction theory of treating

Q14: On November 2,20X9,Henry Company purchased a machine

Q15: Under IFRS 8,at which exchange rate should

Q16: Exchange gains and losses on accounts receivable/payable

Q16: On January 1,20x4,HB Inc.issued 10,000,000 Euros (€)of

Q17: On December 1,20X5,Gillard Ltd.sold goods to International

Q18: On December 1,20X5,Gillard Ltd.sold goods to International

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents