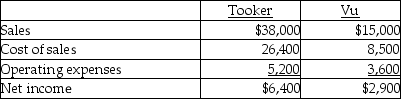

Tooker Co.acquired 80% of the outstanding common shares of Vu Ltd.There were no fair value increments or goodwill that arose with the purchase.During 20X1,Tooker sold $7,000 of inventory to Vu for a gross profit of 40%.At the end of 20X1,$3,000 of the inventory is still in Vu's inventory.On their single-entity income statements for 20X1,Tooker and Vu reported the following:

Vu sold all the goods from Tooker that were in its opening inventory.There were no sales between Tooker and Vu in 20X2.At the end of 20X2,what portion of consolidated net income is attributable to Tooker?

A) $8,400

B) $9,300

C) $9,920

D) $10,500

Correct Answer:

Verified

Q20: A few years ago,Locke Ltd.had purchased a

Q21: On January 1,20X5,PX's shareholders' equity was as

Q22: Bowen Limited purchased 60% of Sloch Co.when

Q23: Tooker Co.acquired 80% of the outstanding common

Q24: Bowen Limited purchased 60% of Sloch Co.when

Q26: Prawn Corporation owns 80 percent of the

Q27: Fox owns 60% of the outstanding common

Q28: On the consolidated statement of financial position,which

Q29: Prawn Corporation owns 80 percent of the

Q30: Lobes Co.owns 65% of Banes Limited.During 20X5,Banes

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents