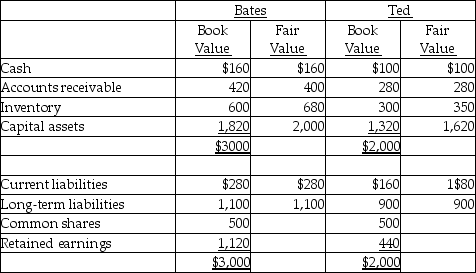

On December 31,20X2,Bates Ltd.purchased 75% of the outstanding common shares of Ted Ltd.for $1,050,000 in cash.The balance sheets of Bates and Ted immediately before the acquisition were as follows (in 000s) :

At the time of acquisition,Ted's capital assets still had a remaining useful life

Of ten years.What is the amount of the adjustment to the net book value of capital assets on the consolidated statement of financial position at December 31,20X2 under the parent-company approach?

A) $ 94,500

B) $135,000

C) $157,000

D) $225,000

Correct Answer:

Verified

Q3: Sunny Co. purchased 80% of Reuben Ltd.

Q4: Arnez Ltd. acquired 70% of Bedard Ltd.

Q6: Amber Ltd. purchased 80% of Patel Ltd.

Q7: Under IAS 27, where does the non-controlling

Q10: In preparing consolidation working papers,why is it

Q12: Which consolidation method includes only the parent's

Q13: Fleming Ltd.acquired 75% of Donner Ltd.at April

Q14: What is the purpose of showing an

Q15: Which consolidation method does not include incorporating

Q17: Portia Ltd.acquired 80% of Siro Ltd.on December

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents