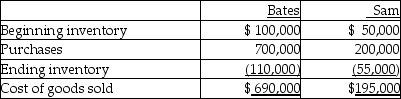

Bates Ltd.owns 60% of the outstanding common shares of Sam Ltd.During 20X6,sales from Sam to Bates were $200,000.Merchandise was priced to provide Sam with a gross margin of 20%.Bates' inventories contained $40,000 at December 31,20X5 and $15,000 at December 31,20X6 of merchandise purchased from Sam.Cost of goods sold for Bates and Sam for 20X6 on their separate-entity income statements were as follows:

What is the non-controlling interest's share of the consolidation adjustments on the income statement for the year ended December 31,20X6?

A) $2,000

B) $3,000

C) $5,000

D) $1,250

Correct Answer:

Verified

Q3: Sunny Co. purchased 80% of Reuben Ltd.

Q14: What is the purpose of showing an

Q17: Portia Ltd.acquired 80% of Siro Ltd.on December

Q20: Portia Ltd.acquired 80% of Siro Ltd.on December

Q21: On September 1,20X5,High Limited decided to buy

Q23: On September 1,20X5,High Limited decided to buy

Q24: Bates Ltd.owns 60% of the outstanding common

Q25: Under the parent-company extension method,to which company

Q26: On December 31,20X5,Paper Co.purchased 60% of the

Q27: On December 31,20X6,the balance sheets of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents