On December 31,20X2,the Esther Company purchased 80% of the outstanding common shares of the Jane Company for $7.5 million in cash.On that date,the shareholders' equity of Jane totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings.Both companies use the straight-line method to calculate depreciation and amortization.Goodwill,if any arises as a result of this business combination,is written down if there is a permanent impairment in its value.

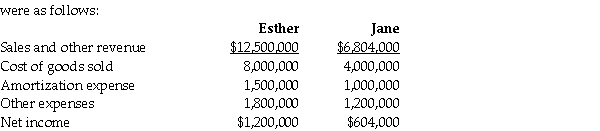

For the year ending December 31,20X4,the statements of comprehensive income for Esther and Jane

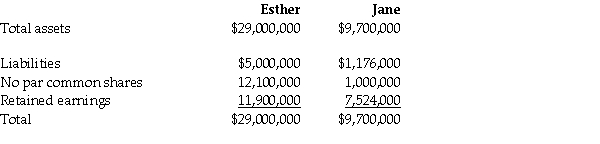

At December 31,20X4,the condensed statement of financial position for the two companies were as follows:

OTHER INFORMATION:

1.On December 31,20X2,Jane had a building with a fair value that was $450,000 greater than its carrying value.The building had an estimated remaining useful life of 15 years.

2.On December 31,20X2,Jane had inventory with a fair value that was $150,000 less than its carrying value.This inventory was sold in 20X3.

3.During 20X3,Jane sold merchandise to Esther for $100,000,a price that included a gross profit of $50,000.During 20X3,40% of this merchandise was resold by Esther and the other 60% remained in its December 31,20X3 inventories.On December 31,20X4,the inventories of Esther contained merchandise purchased from Jane on which Jane had recognized a gross profit in the amount of $20,000.Total sales from Jane to Esther were $150,000 during 20X4.

4.During 20X4,Esther declared and paid dividends of $300,000 while Jane declared and paid dividends of $100,000.

5.Esther accounts for its investment in Jane using the cost method.

Required:

Calculate goodwill on the consolidated balance sheet at December 31,20X4 under the entity method and the parent-company extension method.Explain the differences between the two balances.

Correct Answer:

Verified

Calculation of goodwill at...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: On December 31,20X5,Paper Co.purchased 60% of the

Q27: On December 31,20X6,the balance sheets of the

Q28: On December 31,20X2,the Esther Company purchased 80%

Q29: On December 31,20X2,the Esther Company purchased 80%

Q30: On December 31,20X5,Paper Co.purchased 60% of the

Q30: Devon Ltd. acquired 90% of Luka Ltd.

Q32: Pooke Co.acquired 75% of Finch Ltd.3 years

Q34: Jordan Ltd. acquired 80% of Cool Co.

Q34: On December 31,20X6,the statements of financial position

Q36: On December 31,20X5,Paper Co.purchased 60% of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents