On September 1,20X5,High Limited decided to buy 70% of the shares outstanding of Low Inc.for $630,000.High will pay for this acquisition by using cash of $500,000 and issuing share capital for the remaining amount.The balances showing on the statement of financial position for the two companies at August 31,20X5 are as follows:

After a review of the financial assets and liabilities,High determines that some of the assets of Low have fair values different from their carrying values.These items are listed below:

• Land has a fair value of 225,000

• The building has a fair value of 1,090,000.The remaining useful life of the building is 20 years.

• Patent is $100,000.The patent is estimated to have a useful life of 5 years.

During the 20X7 fiscal year,the following events occurred:

1.On March 1,20X7,Low sold land to High for $390,000,which had a carrying value of $275,000.High paid for this with $90,000 cash and a note payable for the difference.This note pays interest at 10% which is paid monthly.

2.High sold supplies (included in High sales)to Low for $200,000.Profit margin on these sales is 25%.Low still has supplies on hand of $70,000.

3.In 20X6,Low had provided seat space on flights to High for a value of $500,000.This amount was included in sales for Low.Profit margin on these sales is 40%.At the end of August,20X6,High still had an amount of $200,000 in these prepaid seats that had not yet been used.(High includes this in inventory. )

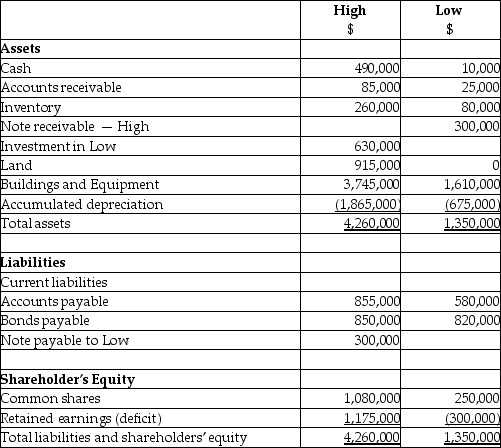

Statements of Financial Position

As at August 31,20X7

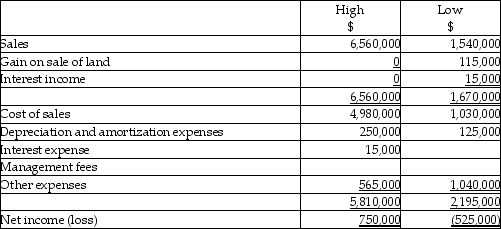

Statements of Comprehensive Income

For the year ended August 31,20X7

Required:

Calculate the balances for the following consolidated balances of High at August 31,20X7 assuming High uses the entity approach:

a.Goodwill

b.Non-controlling interest

c.Buildings and Equipment,net

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: Sunny Co. purchased 80% of Reuben Ltd.

Q7: Under IAS 27, where does the non-controlling

Q14: What is the purpose of showing an

Q17: Portia Ltd.acquired 80% of Siro Ltd.on December

Q20: Portia Ltd.acquired 80% of Siro Ltd.on December

Q22: Bates Ltd.owns 60% of the outstanding common

Q23: On September 1,20X5,High Limited decided to buy

Q24: Bates Ltd.owns 60% of the outstanding common

Q25: Under the parent-company extension method,to which company

Q26: On December 31,20X5,Paper Co.purchased 60% of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents