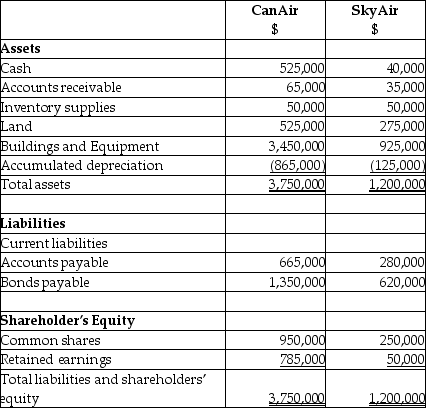

On September 1,20X5,CanAir Limited decided to buy 100% of the shares outstanding of SkyAir Inc.for $900,000.Can Air will pay for this acquisition by using cash of $500,000 and issuing share capital for the remaining amount.The balances showing on the statement of financial position for the two companies at August 31,20X5 are as follows:

After a review of the financial assets and liabilities,CanAir determines that some of the assets of SkyAir have fair values different from their carrying values.These items are listed below:

• Land has a fair value of 225,000

• The building has a fair value of 1,090,000.The remaining useful life of the building is 20 years.

• Internet domain name has a fair value is $55,000.The domain name is estimated to have a useful life of 5 years.

• Customer lists has a fair value is $35,000.It is estimated that the customer lists will have a useful life of 7 years.

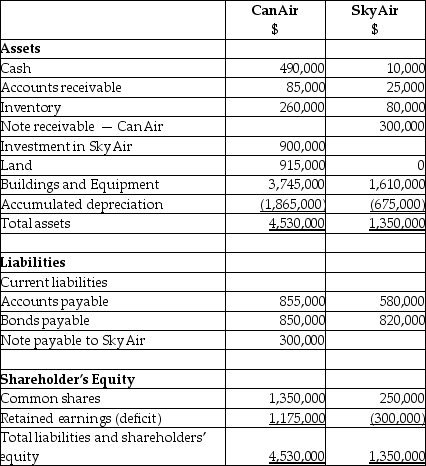

During the 20X9 fiscal year,the following events occurred:

1.On March 1,20X9,SkyAir sold land to CanAir for $390,000,which had a carrying value of $275,000.Can Air paid for this with $90,000 cash and a note payable for the difference.This note pays interest at 10% which is paid monthly.

2.CanAir provided management expertise to SkyAir and charged management fees of $890,000.

3.CanAir sold supplies (included in CanAir sales)to SkyAir for $200,000.CanAir charged SkyAir an amount that was 25% above costs.SkyAir still has supplies on hand of $70,000.

4.In 20X8,SkyAir had provided seat space on flights to Can Air for a value of $500,000.This amount was included in sales for SkyAir.Profit margin on these sales is 40%.At the end of August,20X8,CanAir still had an amount of $200,000 in these prepaid seats that had not yet been used.(CanAir includes this in inventory. )

Statements of Financial Position

As at August 31,20X9

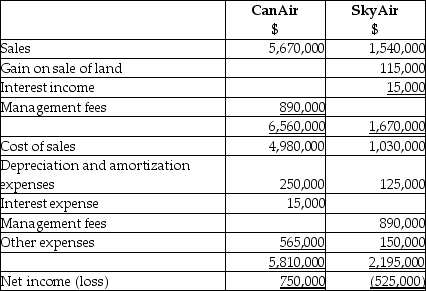

Statements of Comprehensive Income

For the year ended August 31,20X9

Required:

Prepare the consolidated Statement of Comprehensive Income for the year ended August 31,20X9.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: DC Company purchased 100% of the outstanding

Q17: On January 1,20X3,Dwayne Ltd.formed Carlos Co. ,a

Q18: Fair value increments on depreciable assets _.

A)should

Q18: Amber Ltd.acquired Luna Ltd.in a business combination.One

Q19: A subsidiary sold goods to its parent

Q22: On September 1,20X5,CanAir Limited decided to buy

Q23: On December 31,20X1,Dad Ltd.purchased 100% of the

Q25: In 20X1,a parent company sold a tract

Q26: Which of the following consolidation adjustments will

Q26: On December 31,20X2,the Pipe Ltd.purchased 100% of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents