On September 1,20X7,Spike Limited decided to buy 100% of the outstanding shares of Volley Inc.for $1,200,000 paid for with the issuance of shares.In addition Spike has agreed to pay an additional $250,000 if the revenues of Volley have a 5% growth over the next two years from the date of the acquisition.It has been determined that the fair value of this contingent consideration is $175,000.

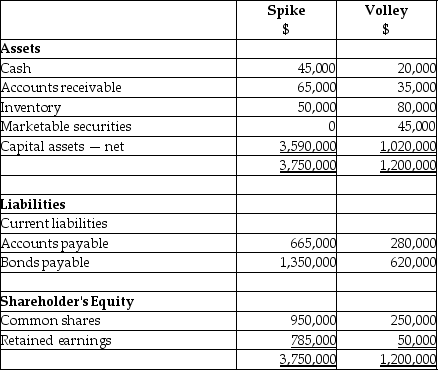

The balances showing on the statement of financial position for the two companies at August 31,20X7 are as follows:

After a review of the financial assets and liabilities,Spike determines that some of the assets of Volley have fair values different from their carrying values.These items are listed below:

Capital assets - fair value is $1,350,000

Patent - fair value is $255,000

Brand name - fair value is $135,000

Required:

Determine the amount of goodwill that will be recorded on the business combination.

Prepare the consolidated statement of financial position as at September 1,20X7.

Correct Answer:

Verified

Fair ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: How should the cost of issuing debt

Q7: Perez Co. plans to acquire Roo Co.

Q19: Q19: Sya Ltd. acquired all the assets and Q21: Push-down accounting requires _. Q23: On January 1,20X7,Falcon acquired the net assets Q24: In Canada,what type of business combination can Q26: Which of the following is not a Q27: On December 31,20X5,CI Co.purchased 100% of the Q37: What does push-down accounting refer to?![]()

A)fair value adjustments to

A)Writing down

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents