On January 1,20X1,Belle Ltd.purchased 100% of the common shares of Dominique Corporation for $700,000.Dominique's net income was $30,000 for 20X1 and $50,000 for 20X2.DA paid dividends of $20,000 on its common shares during 20X1 and $100,000 during 20X2.As such,total dividends paid by Dominique exceeded income earned by Dominique since it was acquired by Belle.What is the balance in the investment in Dominique's account at the end of 20X2 under the cost and equity methods?

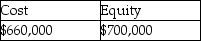

A)

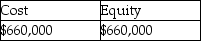

B)

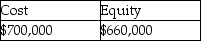

C)

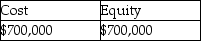

D)

Correct Answer:

Verified

Q1: At the beginning of 20X1, Anwar Ltd.

Q2: Forest Ltd.reports its investment in Leeds Co.using

Q4: At the beginning of 20X1,Anwar Ltd.acquired 15%

Q4: Bela Ltd. has invested in several domestic

Q6: What is securitization?

A)It is the process of

Q9: Passive investments can be classified as fair

Q9: At the beginning of 20X1,Anwar Ltd.acquired 15%

Q12: Townsend Ltd. has the following shareholders: Palermo

Q15: How do joint ventures differ from private

Q17: Which of the following statements about the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents